Thousands of workers across the UK are set to receive a boost in their October pay packets, after a new minimum wage kicked in. The hike was agreed by the Government in March and is a positive step in the world of payroll, after incidents of workers not receiving the minimum recently making national headlines.

The increase will benefit staff aged 24 and under, as well as apprentices. But the change will also have implications for employers, who will have to adjust their payroll accordingly. Here, we look at the increase, what employers need to bear in mind and the penalties firms can face if they don’t pay up.

A boost for young workers

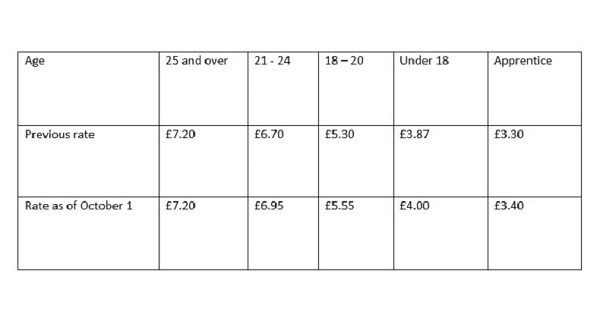

The new minimum wage officially came into effect on October 1, and applies to workers aged 24 and under as well as apprentices. The following rates now apply:

Across the age bands there has been an increase of between 3% and 4.7% with the Youth Development Rate – for those aged 18 – 20 – seeing the biggest percentage hike.

For apprentices the rate changes depending on their age and how far into their course they are. An apprentice aged under 19 will receive the £3.40 rate – and so too will an apprentice over the age of 19 in the first year of their studies.

Once they have completed their first year, and as long as they are aged 19 or over by then, they will be paid £5.95 or £6.95 an hour, depending on what age bracket they fall into.

The minimum wage has increased annually, with the hourly rate for 18 – 20 year olds rising from £4.92 in 2010 to £5.30 in 2015. But unlike in previous years this latest increase is only set to last for the next six months before being reviewed, to pull the minimum wage in line with the National Living Wage – the rate that applies to workers aged 25 and over, that changes in April.

For now the rates are set but they are likely to continue to rise as the Government aims to increase the living wage to more than £9 an hour by 2020.

Bosses take note

It is a criminal offence for employers not to pay their staff either the minimum or national living wage. If a firm discovers they have been paying workers below the correct wage they must pay any arrears immediately – and for those that don’t, they can face hefty fines.

Retail giant Sports Direct could face potential fines as part of an HMRC investigation into its pay for warehouse workers. The company’s boss Mike Ashley told a parliamentary inquiry earlier this year that the company had broken the law by failing to pay some warehouse staff the minimum wage.

And the Government fired a warning shot to firms about under-paying staff in August when it named and shamed a list of nearly 200 employers who failed to pay the national minimum wage – the largest list it has ever published. The companies involved covered a range of sectors, from care homes to hotels and hairdressers to football clubs.

The 197 firms on the list owed a total of £465,291 in arrears to staff, which they have all paid back to workers. Business minister Margot James said at the time that the Government would continue to “crack down on those who ignore the law”.

Sorting your payroll

As well as ensuring you are paying your employees the correct hourly rate, it is also important that companies keep hold of these details. HMRC makes it clear that it is down to employers to ensure they are maintaining records to prove to investigators they are, and have been paying, the minimum wage. All records must be kept for three years.

The easiest way for many firms to do this is through payroll records, which can be presented as proof. HMRC officers have the right to carry out checks on an employer at any time, or if a worker complains about them, so having the right details to hand is imperative.

For many companies, outsourcing payroll is much more efficient than keeping it in-house. At AMR we provide full payroll services, including reports and payslips, that can be provided over different time frames. For more information about payroll services click here or how we can help your firm get in touch here.