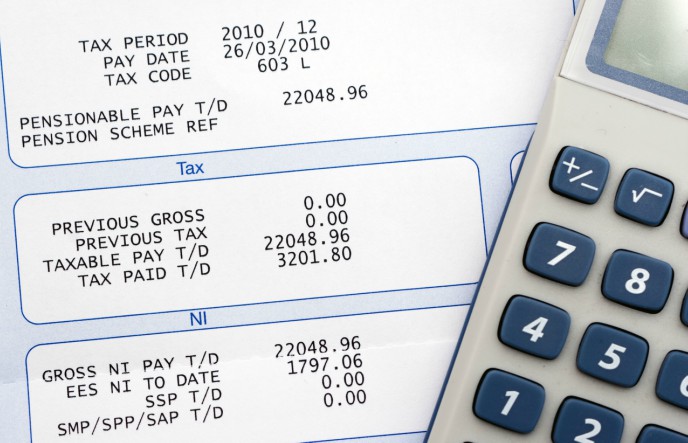

Five common payroll pitfalls and how to avoid them

Payroll mistakes are alarmingly common in businesses of all sizes. Regularly changing legislation, gaps in internal communication and software errors are just some of the problems which could cost a business a considerable sum of money. HMRC collected £737 million in taxes and penalties following a crackdown in payroll tax errors in one year recently. […]

Claiming capital allowances

As a form of tax relief, the ability to claim capital allowances is an incentive for companies to invest in capital expenditure. Claimants must work out their allowance and make their claim to HMRC. Different types of businesses are required to claim capital allowances in a different way. Here, the AMR Bookkeeping Solutions team provides […]

An employer’s guide to paying overtime

If any of your staff work outside their contracted hours, you might be wondering what the UK rules and regulations are around paying overtime. Are employers obligated to pay overtime? Are there limits to how many hours staff can work in a week? And do you need to declare employee overtime on payroll software? The […]

When is the right time to outsource your bookkeeping?

Meticulous bookkeeping is a non-negotiable requirement for any successful business. When your books are in order it makes everything from tax preparation to financial planning, and even applying for business credit, much easier. For businesses in their infancy, bookkeeping is a task that is usually done in-house. However, in the long-term, many businesses find that […]

Electric vehicle salary sacrifice schemes

With individuals and businesses across the world looking to make eco-friendly choices, many employers are now offering electric vehicles as part of their salary sacrifice car schemes. In light of the UK Government’s goal to end the sale of new petrol and diesel vehicles by 2030, and tax cuts incentivising employees to opt for low […]

Employing an apprentice – everything a company needs to know

Employing an apprentice is an excellent way to expand and upskill your workforce, and train new staff according to the needs of your business. However, when employing an apprentice there are a number of wage, funding and contractual considerations that you must take into account. Here, our AMR Bookkeeping team provide a guide to everything […]

What to do when an employee leaves

When an employee tells you they are leaving, there are a number of things you need to do. Whether they are moving to a new organisation or retiring, you need to tell HM Revenue and Customs (HMRC), and make sure that you deduct and pay the correct National Insurance and tax. Here is AMR Bookkeeping […]

A guide to annual payroll reporting and tasks

With the new financial year underway, this year’s annual payroll reporting tasks are nearly complete. The changing of the tax year is always a busy time for anyone responsible for payroll, as there are many tasks that need to be carried out for each employee, in adherence to HMRC’s deadlines. To help you get prepared […]

What should an employer do if an employee changes gender?

Since the Gender Recognition Act was implemented in 2004, trans people have been legally able to change their gender following the receipt of a Gender Recognition Certificate. In this blog, we outline what an employer needs to do if an employee tells you they’ve changed gender. What should I do if my employee changes gender? […]

A guide to child maintenance deductions for employers

There are around 5.3 million couples living with dependent children in the UK. However, the sad fact is there are more than 2.3 million families where at least one parent no longer lives with their child. When parents separate or no longer live with their child, a child maintenance agreement should be made. What is […]