Bookkeeping for a handmade craft business

With the rise in the cost of living and the move towards a better work/life balance, many people consider setting up a small business making and selling handmade crafts, either as a second income stream or their main livelihood. If you have a talent for crafting, whether it’s crotchet, pottery, upcycling old furniture or painting, […]

Bookkeeping for freelance musicians

If you’re a freelance musician, you’ll probably be leading a pretty hectic life. A professional violinist can be recording a new commission in London, playing with a major orchestra in a live concert, making up a string quartet for a commercial engagement and working as a peripatetic music teacher – often all in the same […]

A small business guide to holiday pay for employees

Everyone needs the occasional break to recharge both physically and mentally and return with (hopefully) fresh purpose and enthusiasm for work. However, calculating holiday pay can be an unnerving task for employers running small businesses, as UK legislation governing leave entitlement is not always easy to decipher without HR staff to investigate the complexities. Post-pandemic, […]

Bookkeeping for the construction industry – what do you need to know?

Making sure the books balance is critical for the successful running of any business, whatever its size. However, there are some sectors for which this is more complicated, and the construction industry, a key part of the UK economy, is one of these. It’s a fairly volatile industry, with sometimes dramatically fluctuating profit and loss, […]

September Newsletter

September Newsletter 2023 Morning/afternoon According to the meteorological season Autumn starts on 1 September whereas from an astronomical viewpoint it is 23 September – whichever date you choose to accept Summer is over we hope you had an enjoyable one. On 16 September we will be wishing our very own Paul Parsons the best of […]

Five tips to help your business avoid a tax audit

As a business owner, you’re probably spinning plenty of plates on a day-to-day basis including sales, marketing, manufacturing, R&D as well as (we hope) staying on top of your bookkeeping. The last thing you want to receive is notification from HMRC that you’re going to be subject to a tax audit. However honest and meticulous […]

Maximising tax deductions with effective bookkeeping strategies

For all businesses, particularly in today’s economic climate, every penny counts, and making the most of all the tax savings for which you are eligible should be a vital part of your bookkeeping process. Every business will have its own specific entitlements, and keeping abreast of these can save a surprising amount of money to […]

How to keep up with bookkeeping during busy periods

Many business owners find a great deal of satisfaction in ensuring their bookkeeping is up to date and accurate, although it does mean setting up an efficient and orderly system and actually sticking to it! However, most businesses will have quiet periods and other times when everyone is rushed off their feet. A company making […]

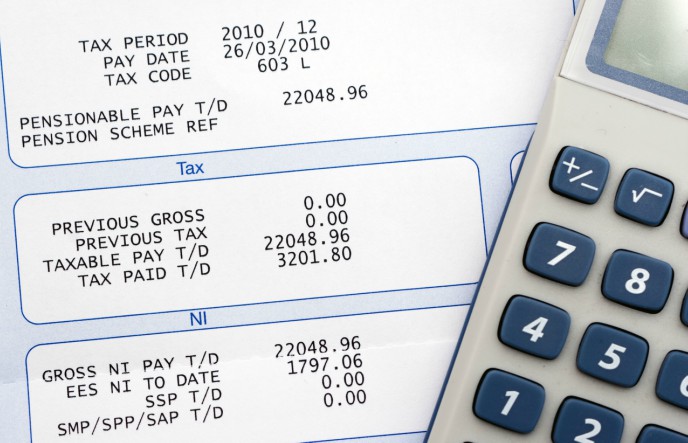

Five common payroll pitfalls and how to avoid them

Payroll mistakes are alarmingly common in businesses of all sizes. Regularly changing legislation, gaps in internal communication and software errors are just some of the problems which could cost a business a considerable sum of money. HMRC collected £737 million in taxes and penalties following a crackdown in payroll tax errors in one year recently. […]

Bookkeeping for charities – what do you need to know?

Keeping meticulous financial records is a must for any business, large or small. Without this input, maintaining cash flow accuracy, filing tax returns and other important duties take twice as long. For charities, however, which receive money from the public in the expectation of using it for specific good causes, this is an even more […]