March Newsletter

Over the last quarter the team said farewell to Isobel, our trainee payroll administrator and admin assistant – Izzie will be pursuing her dream equine job travelling the world for show jumping competitions.

This does mean AMR are recruiting for a new member of the team and we hope to have news on this later in the year.

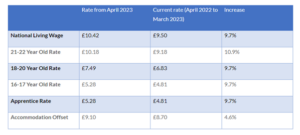

Minimum Wage Increase

As April fast approaches the national minimum wage will be increasing as per the below table.

Forms P60’s to your staff.

Additionally, as the financial year comes to a close, as an employer, you should be producing P60s for all your employees who are on your payroll as at 5 April 2023. The deadline for handing these to your employees is 31 May 2023. Employees who left your employment before 5 April 2023 will not receive a P60 from you as they would have had a P45 when they left.

Of course if AMR processes your payroll then we will take care of this for you.

Newsletter’s 4th Anniversary

When we began our journey back in 2019 preparing quarterly newsletters for our clients we were a little sceptical that there would be enough to talk about. 16 newsletters later just goes to show the evolving world of payroll and bookkeeping and of course AMR.

We have covered an array of topics from MTD and CIS reverse charge to furlough and Covid provision schemes. Our previous newsletters can be found on our newly designed website, along with a number of other blogs – https://amrbookkeeping.co.uk/news/.

Many thanks

The AMR Team