Tax codes – they’re the odd looking combination of numbers and letters on your payslip. They might seem fairly insignificant at first glance, but what do they really mean? And how do you know if yours is correct?

Here, we discuss what tax codes are, how to ensure yours is correct and what to do if it needs amending.

What is a tax code?

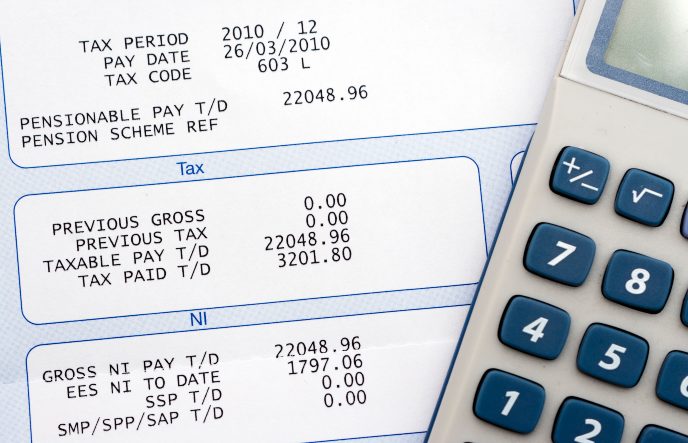

A tax code is used to determine the amount of Income Tax you should pay. Employers and pension providers use this code to work out any relevant deductions from your pay or pension. The tax code will normally start with a number and end with a letter. For example, 1257L is the most commonly used tax code for people who have one job or pension.

What do the numbers and letters on a tax code mean?

The numbers on a tax code indicate how much tax-free income you are entitled to for that tax year. Determining the numbers in your tax code is based on:

- Your tax-free Personal Allowance

- The total amount of income that you have not paid tax on e.g. any additional earnings or untaxed interest, which is added to the value of any benefits from your job, such as a company car

- The income you have not paid tax on is then deducted from your Personal Allowance. The amount leftover is the tax-free income you are allowed for that tax year

- The last digit in the tax-free income is removed. Therefore, if you are on the standard Personal Allowance, which is currently £12,570 then the number in your tax code would be 1257

The letter at the end of the tax code is based on your situation and how it affects your Personal Allowance. For example, the letter ‘L’ means you’re entitled to the standard tax-free Personal Allowance. While the letters ‘OT’ mean your Personal Allowance has been used up, or you’ve started a new job and your employer does not have the details they need to give you a tax code.

You can find a full list of what the tax code letters mean on the government’s website here.

What are emergency tax codes?

If your tax code has ‘W1’, ‘M1’ or ‘X’ at the end then these are emergency tax codes, meaning you will pay tax on all your income above the basic Personal Allowance.

Tax codes with a ‘K’ at the beginning mean you have income that is not being taxed another way and it is worth more than your tax-free allowance. For the majority of people, this is usually when they’re paying tax they owe from a previous year through their wages or pension or when they are getting taxable benefits, such as state benefits or company benefits.

How are tax codes updated?

If you are on an emergency tax code due to a change of job, then it will be automatically corrected once you’ve provided your new employer with a P45 from your previous position. HMRC might also change your tax code if other things change, such as:

- You are receiving income from an additional job or pension

- Your employer has started or stopped giving you benefits related to your job

- You receive taxable state benefits

- You claim Marriage Allowance or expenses that are tax deductible

If your tax code changes, HMRC will notify you in writing via an email. They will also advise your employer or pension provider. You will also be able to see the updated tax code on your next payslip and any relevant adjustments.

If you pay too much or too little tax over a tax year, HMRC will issue you with a P800 or a Simple Assessment tax calculation. This will advise you on how to obtain a refund or how to pay the tax you owe.

What happens if a tax code is incorrect?

If you believe your tax code is incorrect you should contact HMRC using its online Income Tax Service. If you are uncertain about your tax code for any reason, you should speak to a professional bookkeeper or accountant, such as AMR Bookkeeping Solutions, who will be able to assess your circumstances and confirm if your tax code requires updating.

If you need further information or advice about tax codes, we are here to help. Please give us a call on 01892 559480, or get in touch with our friendly team via our online enquiry form.