If you are an employee, at the end of every financial year (5 April) you will be issued with a P60 by your employer. You might think that a P60 seems of little use and is just another piece of paper to be filed away with all your other documents, but P60s are extremely important for determining your income tax position and showcasing your National Insurance contributions.

Here, we explain what P60s are and why you need one.

What is a P60?

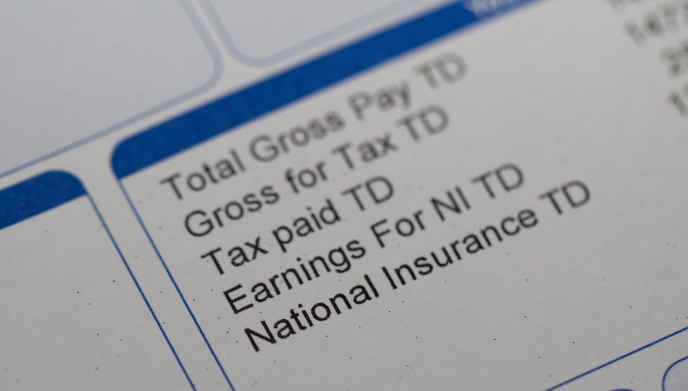

A P60 is a summary of your payslips for the year. It is how much you have been paid, the total tax paid, and your National Insurance contributions taken from it.

The tax year runs from 6 April to 5 April of the following year. You will receive a P60 for each job you have had during the year, so if you were employed by two different businesses, then you will receive two separate P60s – one from each employer.

An employer must give you a P60 – by law. A P60 can be given to you on paper or electronically.

Does everyone get a P60?

Yes, all employees will be given a P60 at the end of the tax year.

When should I receive my P60?

If you are an employee, you will typically receive your P60 at the end of the tax year, which runs from 6 April to 5 April of the following year. Employers are required to issue P60 forms to their employees by 31 May following the end of the tax year.

Why do I need a P60?

If you are planning to claim back overpaid tax, you want to apply for tax credits, or you need proof of income, such as when taking out a loan or mortgage, then you will need your P60 for this. However even if you are not expecting to do any of the above, we recommend keeping your P60 safe for the same timeframe – just in case.

How do I know if I have paid too much tax?

The HMRC will usually contact you to inform you that you have paid too much income tax. They will send you either:

- a tax calculation letter (also known as a P800)

- a Simple Assessment letter

You will usually either receive a refund (or tax rebate) or have your tax code changed for the next year to make up the difference.

If you believe you have overpaid tax and haven’t heard from the HMRC, you can complete a tax return and send it to the HMRC. They should then send you a repayment once they have processed your tax return. You can find all the details here.

How do I know if I have paid too little tax?

The HMRC will contact you if they believe you have not paid enough income tax. This will usually be collected by reducing your PAYE tax code for the next tax year – providing you have enough income over the personal allowance to cover the unpaid amount. However for amounts over £3000, you will be asked to pay the HMRC directly.

What does my tax code mean?

There are many different tax codes, and each correlates to how much tax you need to pay. The standard tax code is currently 1257L. This means you are allowed to earn 12,570 tax free, and only pay tax on anything earned above this.

However, you may notice your tax code is different. You can find out what your tax code means here.

Is a P60 proof of income?

Yes, a P60 can be used as proof of income. However, if you are applying for a loan or a mortgage, for instance, you may also be asked for between three and six months’ worth of payslips.

Is a P60 the same as a P45?

No, a P60 and a P45 are different. As an employee, you may come across both a P45 and a P60 often, so it’s important to know the difference.

A P60 is used to summarise the employee’s tax information for that tax year and is issued at the end of the tax year. A P45, on the other hand, is used when employees change jobs. A P45 contains details of your salary and the taxes you’ve paid during the tax year.

It is always an employer’s responsibility to make sure an individual receives their P45 as soon as possible when they leave their job.

How long should I keep a P60 for?

If you receive your P60 on paper, it can be tempting to throw it away every year. But it is good practice to keep your P60s for three years from the end of the tax year they relate to.

If you receive your P60 electronically, it can be easier to store them. But it is a good idea to make sure you have easy access to them for the same time period. This will make it easier to check your tax codes and the amount of tax paid should there be any queries about your tax.

What happens if my employer hasn’t given me a P60?

If for any reason you cannot get a P60 from your employer, for example if they are no longer operating, then you can either use your personal tax account to view or print out the information that would be on your P60 or you can contact HMRC to ask for more information.

How do I issue a P60 if I am an employer?

It is essential that you give all your employees a P60 at the end of each tax year. You can use your payroll software to do this. Alternatively, a professional bookkeeper and payroll expert, like AMR Bookkeeping Solutions, will be able to handle this for you. You can find out more about our payroll services here or read our blog The headache of payroll – and how we can help, which provides more insight into how we can manage the process on your behalf.

If your software cannot create P60s, then HMRC also offers basic tools for producing P60s.

A small number of employers are exempt from filing payroll online, such as if you are employing someone to provide care or support services at or from your home. You can find out more about the criteria for this and who is exempt from filing online on HMRC’s website here.

For further information or advice about P60s or the payroll process, please get in touch with our friendly team on 01892 559480 or use our online enquiry form.