Payroll mistakes are alarmingly common in businesses of all sizes. Regularly changing legislation, gaps in internal communication and software errors are just some of the problems which could cost a business a considerable sum of money. HMRC collected £737 million in taxes and penalties following a crackdown in payroll tax errors in one year recently.

Even major names aren’t immune. In 2017 Tesco had to reimburse 140,000 current and former staff members a total of £9.7 million after payroll errors meant they were paid below the national minimum wage, a costly slip which came about during the implementation of a new payroll system.

We look at five of the most common problems and how to avoid them:

1. Falling behind on compliance

Legislation concerning payroll and employment is constantly being updated and it’s vital to keep on top of requirements. Many of the more complicated regulations, such as auto-enrolment in workplace pension schemes, are rolled out over a number of years and have multiple deadlines for different companies depending on size. One of the most recent came into force on April 6 this year; employers now have to provide the number of hours worked on each employee payslip. Non-compliance with any of the regulations carries severe penalties and can also damage a company’s reputation. It’s vital to have a system to keep on top of all the deadlines, which brings us neatly to the next problem:

2. Missing deadlines

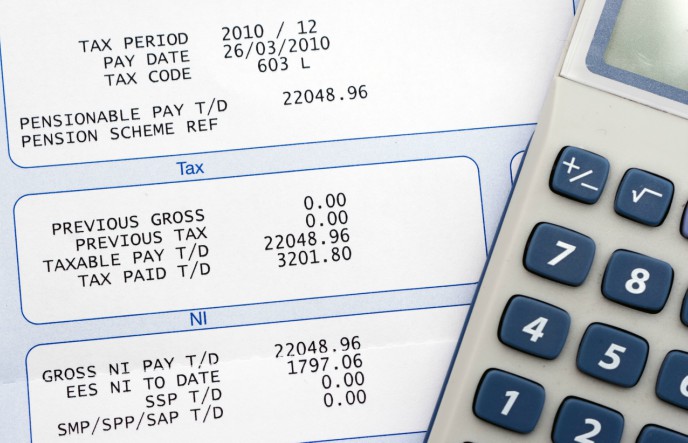

Payroll administrators will tell you that being a stickler for deadlines is one of the most important aspects of their job. Missing dates for employees’ payments, tax and National Insurance contributions can result in penalties and interest being charged. Robust processes for ensuring deadlines are met need to be put in place from the start and regularly updated. In addition, company policies for compliance must be rigidly adhered to.

3. Unreliable data entry

A business may have all the correct information to hand and be aware of the necessary deadlines, but data is only as good as the accuracy of the person entering it. Careless typing can cause myriad problems and be extremely difficult to spot retrospectively. Procedures must be set in place to cross-check data entry.

4. Errors in employee classification

Work patterns are becoming increasingly flexible, and businesses are no longer entirely composed of full-time permanent staff. An additional combination of part-timers, freelancers and temporary staff means increasing risks of misclassification, resulting in incorrect tax calculations which take time and cost money to sort out. Clarity of information must be ensured in conjunction with the HR department prior to data entry.

5. Over-reliance on payroll software

There are some excellent payroll software programs but it’s very important to invest in the necessary training to enable staff to utilise it properly, and ensure there is back-up both if the computer goes down or the administrator is absent.

With a growing number of complex rules surrounding payroll, businesses are benefiting from outsourcing it. At AMR Bookkeeping Solutions, our professional team can advise on software, process your payroll weekly, fortnightly or monthly, meet deadlines, ensure compliance, and leave you free to run your business. Read how we can help you here and get in touch if you’d like to discuss your payroll issues.