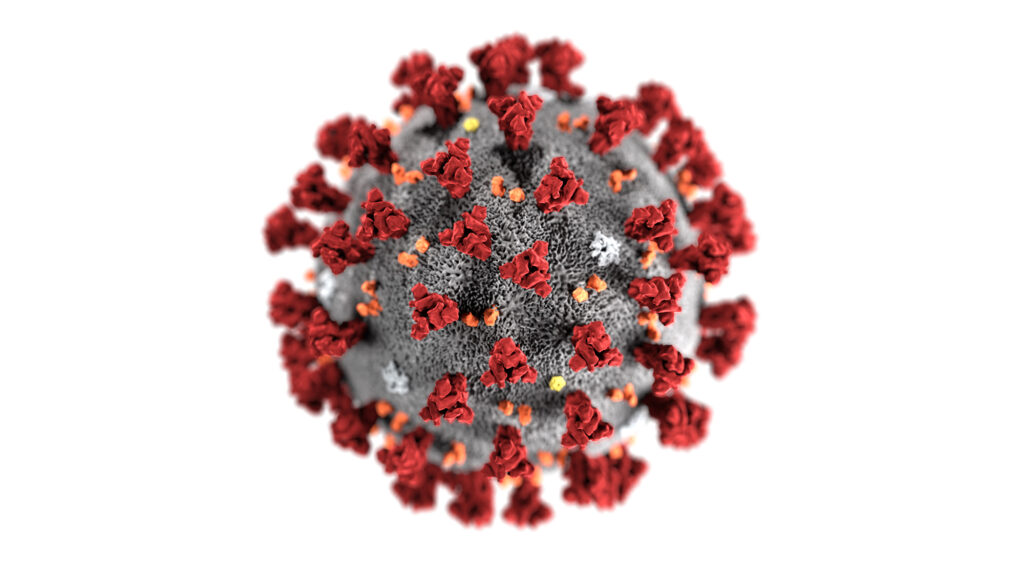

COVID-19 Updates

Please find below all updates and current news regarding the changing circumstances surrouding the COVID-19 outbreak. 25/01/2021 Have you deferred VAT? If you deferred VAT between 20 March and 30 June 2020 and still have payments to make, you can: pay the deferred VAT in full on or before 31 March 2021 opt in to the […]

Common bookkeeping terms and what they mean

At AMR Bookkeeping Solutions we are always looking for ways to help make things easier for our clients. Whether it’s providing advice about payroll, assisting you with auto enrolment or managing your VAT returns, we understand that sometimes the terminology associated with bookkeeping can be somewhat confusing. Here, we’ve put together a list of the […]

The importance of accurate bookkeeping for audits and investigations

As a business owner there’s always the possibility that things might not go according to plan. While no one can predict the future, you can make preparations to ensure that when the unexpected happens you are in the best position possible to mitigate any potential fallout. Bookkeeping is essential to ensuring you have a clear […]

Budgeting for business – how to ensure every penny counts

It’s easy to get bogged down in the nitty gritty of the day to day running of a business, but to truly make your business a success you should ensure you are working to a clearly defined budget. If you’re hoping to invest in your business with a new idea, such as a new website […]

Can I claim back expenses while working from home?

With thousands of office workers forced to work from home during lockdown, setting up a desk from the kitchen table has now become an attractive option for companies looking to reduce overheads and slash rents. According to the Office for National Statistics, almost half of British workers were working away from their office or factory […]

Subcontractor in the construction industry? How AMR can help you claim Construction Industry Scheme (CIS) refunds

If you work in the construction industry, either as a contractor or subcontractor, then you should be aware of Construction Industry Scheme deductions. Launched to prevent tax evasion in the construction industry, any contractor which employs subcontractors is required to deduct money from subcontractors’ payments and pass it to HMRC. These deductions are then used […]

Starting a business while on furlough – everything you need to know

More than 9.5 million people have been put on furlough since the government’s Job Retention Scheme started in April. While the scheme helps to safeguard jobs, it doesn’t guarantee that all jobs will be saved when the scheme comes to an end in October. If you’re on furlough, or facing the threat of redundancy, you […]

A prime time to train? Putting our Xero expertise in the spotlight

Here at AMR Bookkeeping Solutions, we are proud to be Silver Xero Champions, and home to a team of highly qualified, certified bookkeeping and payroll specialists who can assist you with all your bookkeeping needs. While we are adept at operating Xero bookkeeping software on your behalf, it is often preferable for our clients to […]

COVID-19 FAQs: we answer your bookkeeping concerns

The world has changed considerably over the past few months for everyone and, despite the easing of lockdown bringing some green shoots of optimism for businesses, many companies still have concerns about their operations, employees and cash flow. Knowing where to turn when things get tough isn’t always obvious. However, when it comes to your […]

Self-employed and affected by coronavirus?

Being self-employed offers a great deal of freedom. Not only does it provide the possibility of organising and managing your working schedule as you see fit, it also allows you to take control of your future and steer it in a way that works for you and your family. However, it’s not always plain sailing […]