Reclaiming statutory sick pay for Covid-related absences – what you can reclaim and how to do it

Ninety-six pounds a week, for up to 28 weeks – employers have a legal duty to provide at least this statutory level of sick pay (SSP) to any employee that takes sick leave. Pre-covid, the costs of sick pay were always covered by the employer and could not be claimed back. This changed in May […]

What is the difference between a bookkeeper and an accountant?

Bookkeeping and accounting are key activities for almost every business, charity and public body. Both professions handle critical financial information, and provide a dedicated service to their clients. To understand the differences, it is worth taking a closer look at what bookkeepers and accountants do, and to understand when you need one and not the […]

Wishing you a very happy Christmas from everyone at AMR Bookkeeping

As we approach the end of 2021, the team at AMR Bookkeeping would like to wish everyone a very happy Christmas and new year. While the past year has had its ups and downs for businesses across the UK, we have continued to be inspired by the resilience and dedication shown by our clients through […]

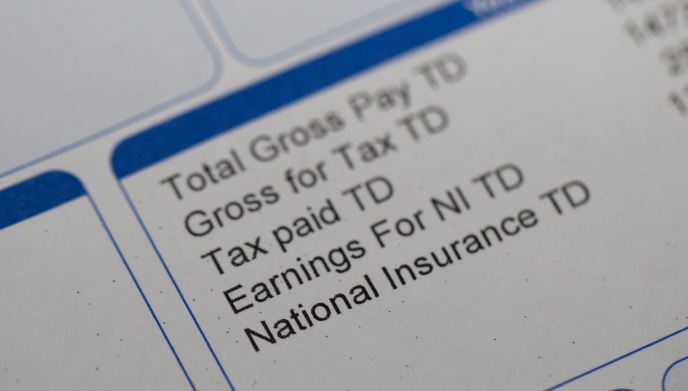

Our guide to National Insurance

Taxes – they can all seem like a bit of a drag, can’t they? However, they are essential to ensuring that economies can operate and that citizens benefit from a range of essential services, including healthcare, education and security. National Insurance is no exception and is a fundamental component of the welfare state system in […]

Everything you need to know about P60s

If you are an employee, at the end of every financial year (5 April) you will be issued with a P60 by your employer. You might think that a P60 seems of little use and is just another piece of paper to be filed away with all your other documents, but P60s are extremely important […]

Our guide to everything you need to know about P45s

Taxes can often be confusing with lots of complicated jargon to understand and mountains of paperwork to wade through. A P45 might sound familiar, but you may be uncertain about what it is, how to use it and if you really need it. Here, we discuss everything you need to know about P45s, from how […]

Maternity, paternity and shared parental leave: here's what you need to know

Welcoming the arrival of a baby is always exciting but understanding the different options of leave available to an employee, and their rights during this time, can be confusing. Here we discuss everything you need to know about maternity, paternity, and shared parental leave. Maternity Leave How long is maternity leave and when does it […]

September Newsletter

In the last quarter, AMR have had some changes in our payroll team. Sadly, we have said goodbye to Emma Rogers. But we are also so excited to welcome Kim to our payroll department. HMRC PENALTIES REFORM The new points based penalties take effect from the first VAT return period starting on or […]

Started a new online company during Covid? Read our must-know bookkeeping tips

Whether through choice or circumstance, the UK has seen a surge in start-up businesses since the COVID-19 pandemic began. According to Companies House, there were more than 770,000 new businesses launched in 2020 – more than double the number created between 2010 and 2017. Given our reliance on the internet for shopping and other […]

Covid-related phishing scams – beware fake HMRC messages

Scammers claiming to be from HMRC are continuing to exploit the COVID-19 crisis. Sole traders and small businesses are particularly at risk from the latest scams that trick people into believing they are due a tax refund or a special payment in relation to the pandemic. So what are the fraudsters’ latest tactics? Here we […]