What is VAT?

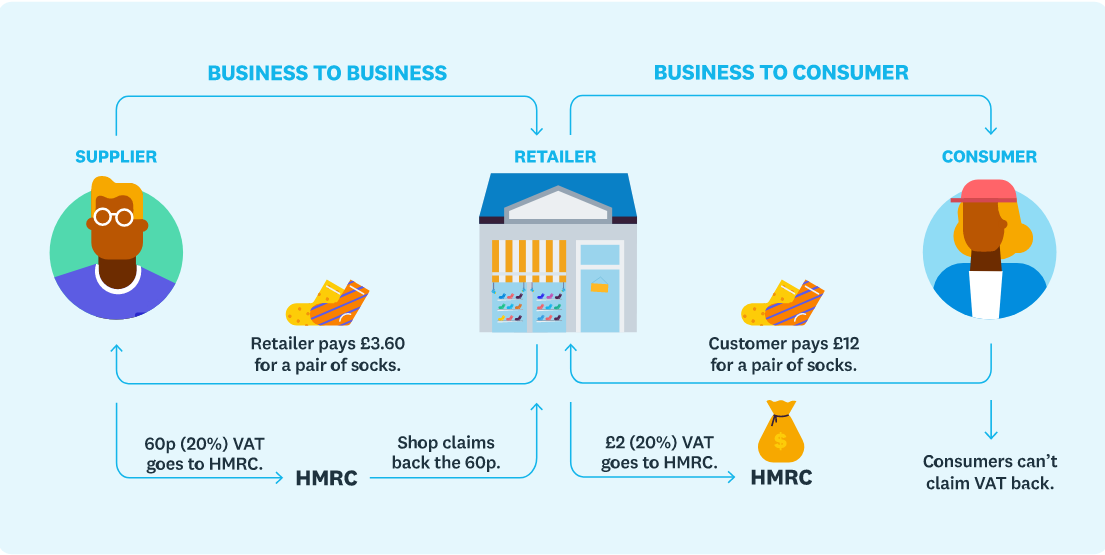

Value Added Tax is a government tax on goods and services, and it’s based on the increase in value of a product or service at each stage of production and distribution. The rate of VAT depends on the nature of the goods or services being sold and purchased.

It was initially brought in during Edward Heath’s prime ministership in 1973, as part of the UK’s condition of joining what was then the European Economic Community, and it started off as a simple 10% tax on nearly all goods bought from a business. It replaced the Purchase Tax, which was a complicated system with numerous different rates within it, and is administered by HMRC. VAT is the third largest source of government revenue after income tax and National Insurance, and it generated £125.3 billion in 2017/2018.

Do I need to register for VAT?

All businesses that provide taxable goods and services must register for VAT if their taxable turnover is more than £85,000, although if they have a lower turnover they can still choose to register.

Registered businesses must pay HMRC the VAT they have charged, but they may offset this with the VAT they have incurred on goods or services they have purchased.

What are the benefits of being VAT registered?

• Selling to a VAT registered business? They can reclaim the VAT from HMRC so your selling price will be competitive and you can recover the VAT on your costs.

• Having to maintain up-to-date records will mean you are better informed about the running costs of your business.

• You can claim VAT on certain items that you purchased prior to the date of VAT registration.

• You can reclaim the VAT!

• Your Vatable sales are lower than your Vatable costs. This may be because you’re accumulating stock or because your sales are below the standard rate of 20% at either the reduced rate of 5% or zero rate 0%.

What are the disadvantages to being VAT registered?

• There will be an increase in your admin and bookkeeping fees. But there is a huge amount of software that can help you. At AMR we can also you train on this software and help you prepare for the move.

• If your customers are not VAT registered than you could appear 20% more expensive.

VAT registration and Making Tax Digital (MTD)

From 1 April 2022 anyone who is VAT registered will have to comply with Making Tax Digital (MTD)